Turkey’s current account deficit, about $65 billion last year, is the ailing side of the country's economy. Ankara’s middle-term economic program projects the gap downward, to $55.5 billion, by the end of 2014. More optimistic projections see it narrowed even further, below $50 billion. Trying to reduce the gap without reducing dependence on foreign energy supplies would, however, require a complex effort.

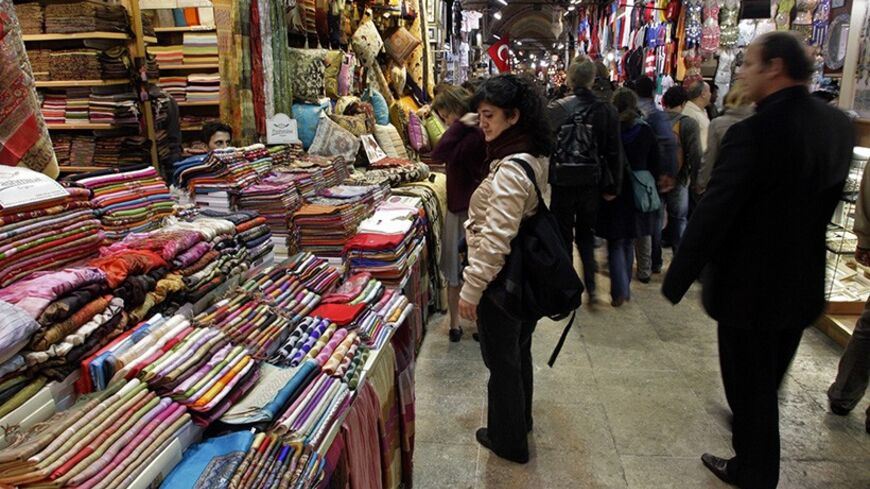

The elusive goal of a lower current account deficit requires a reduction in imports and a boom in exports, as happened in gold. While $727 million worth of gold was imported in the first two months of 2013, $413 million worth of gold was exported for the same period this year. It is a figure that helps reduce the current account deficit. Similarly, export items such as textiles and ready-to-wear clothing, which depend little on imports, are major antidotes against the current account deficit. The textile sector produced a current account surplus of $15.2 billion in 2013.