Could Etihad Airways become first Gulf airline to launch IPO?

The airline reported on Wednesday that it made a net profit for 2023 and 2022 after a string of substantial losses since 2016.

The boss of Abu Dhabi-based Etihad Airways has signaled a potential initial public offering as early as this year, a move that would make it the first Gulf airline to float shares on the stock market.

CEO Antonoaldo Neves gave an interview with CNBC published Wednesday, saying that the airline was preparing to potentially go public after revenue soared in 2023 due to a 40% boost in passenger numbers. The figures marked a rebound following the COVID-19 pandemic, which grounded flights all around the world and put millions of people off traveling.

“I’m working to be ready whenever it’s the time,” Neves told the channel.

Bloomberg reported last week that ADQ, Abu Dhabi’s sovereign wealth fund that owns the airline, was in talks with banks about an IPO.

Although Neves said it was not for him to confirm shareholder decisions, he said, “It’s our obligation to be ready to IPO the company whenever the shareholder believes it is the right time,” adding, “This is good even if you don’t do it.”

Neves has experience in listing an airline, having taken Brazilian carrier Azul public in 2017.

Financial recovery

The executive's comments come as Etihad reported a $394 million operating profit in 2023 Wednesday, thanks to a 40% surge in passenger numbers to 14 million. It added 15 new destinations in 2023 and grew its fleet by 14 aircraft. It also disclosed achieving profits in 2022 after a run of significant losses since 2016.

Along with the challenges COVID-19 inflicted on the airline industry, the UAE carrier's parent company, Etihad Aviation Group, had been hemorrhaging capital due to a previous strategy of buying stakes in different airlines globally. Some of them took huge losses and even fell into bankruptcy, such as Air Berlin (29.21% share in 2011) and Italy’s national airline Alitalia (49% share in 2014). The Italian government founded ITA Airways in 2020 to succeed its insolvent cousin.

After Air Berlin filed for bankruptcy in 2017, the same year as Alitalia, the German airline’s administrator sued Etihad for €2 billion ($2.17 billion).

Etihad’s aggressive expansion strategy also involved committing to large orders for new generation aircraft such as the Boeing 777X series as well as the 787 Dreamliner and Airbus A350. Analysts argued at the time that the airline had too many aircraft and was not filling them all with passengers.

In October 2022, ADQ took control of Etihad Aviation Group, which was previously wholly owned by the government of Abu Dhabi.

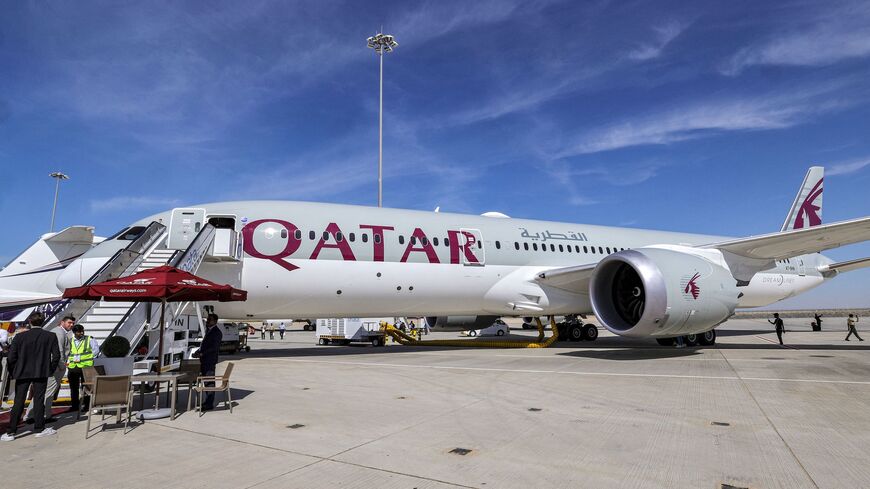

Etihad is one of the “big three” Gulf airlines with Dubai-based Emirates and Qatar Airways. For years there had been speculation that Emirates would be the first Gulf carrier to tap the public markets but the carrier has never launched an IPO, instead preferring to fund itself through other financial instruments like commercial debt or sukuk, or Sharia-compliant bonds.

ADQ declined to comment on a possible Etihad IPO.