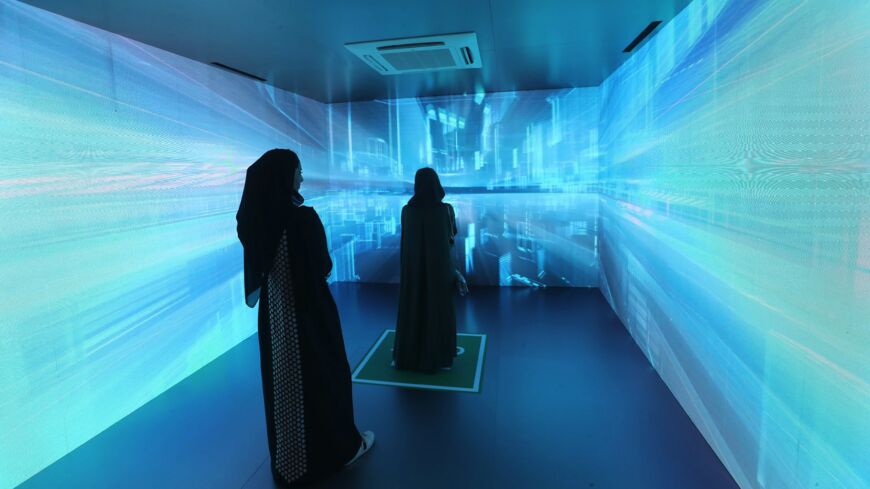

Why AL-Monitor?

AL-Monitor is an award-winning media outlet covering the Middle East, valued for its independence, diversity and analysis. It is read widely by US, international and Middle East decision makers at the highest levels, as well as by media, thought and business leaders and academia.

Read by

Live news & notifications

Premier analysis of the Middle East

Live events & video

Specialized Newsletters

Big, exclusive interviews

ALM archives since 2012

Subscribe for unlimited access

By becoming an Al-Monitor subscriber, you drive our team’s rigorous and independent journalism spanning the Middle East.

Continue