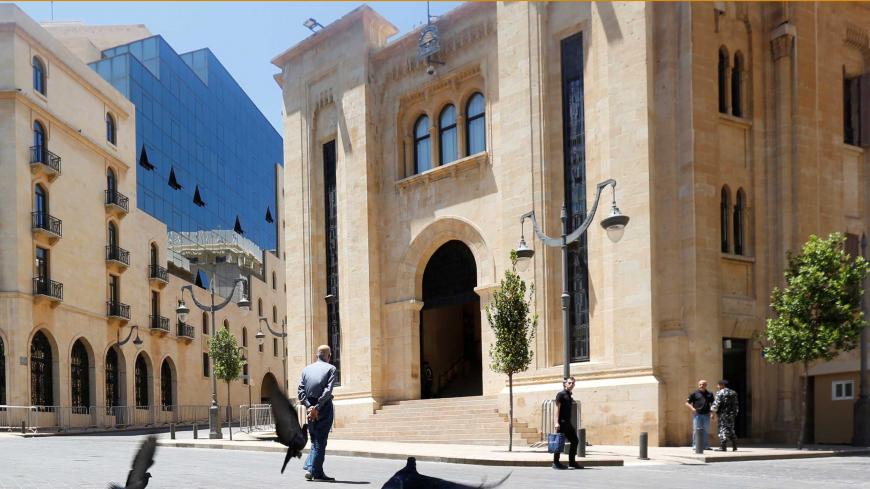

Lebanon's parliament passed a new tax law Oct. 9 to fund raises for its civil servants, after repeated delays and a strike Sept. 25-28 by public sector workers. However, opponents said they will continue to challenge the law.

In July, the Lebanese parliament passed Law No. 46/2017 pertaining to a raise for civil servants — after several years of dithering. This law was accompanied by Law No. 45, which contains a series of taxes to finance the raises, the total cost of which is estimated at between $1 billion and $2 billion a year.