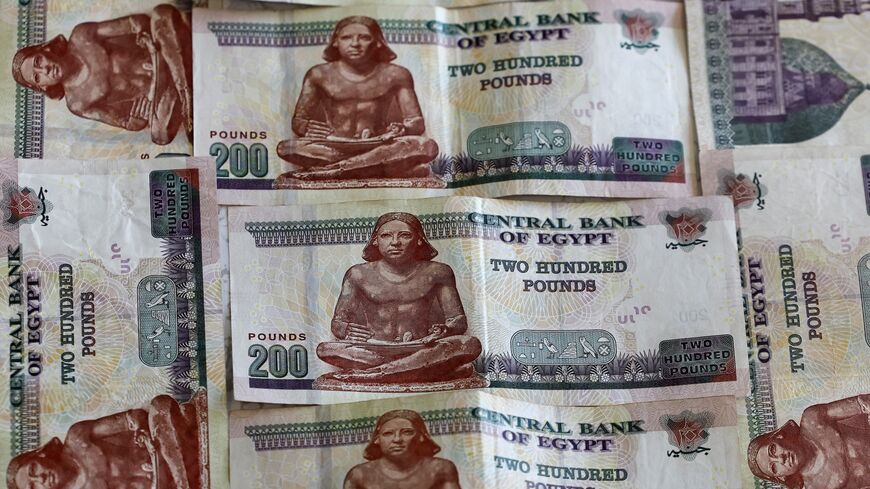

Egypt, UAE sign $35 billion development deal amid foreign currency crunch

The deal could help Egypt’s struggling economy and builds on previous Emirati investment in the North African country.

Egypt unveiled a multibillion-dollar coastal development deal with the United Arab Emirates on Friday as the North African country seeks foreign investment to mitigate its economic crisis.

The Abu Dhabi-based sovereign wealth fund ADQ announced plans to invest $35 billion in Egypt. The fund will acquire the development rights for Ras El-Hekma, a coastal area west of Alexandria, for $24 billion. Another $11 billion will go toward additional investment projects throughout Egypt, the official Emirates News Agency reported.

Egyptian Prime Minister Mustafa Madbouly said the project would include residential areas, hotels, resorts and entertainment venues. It will also feature a business district and a marina for yachts, among other facilities. Madbouly added that the $35 billion investment will reach Egypt within two months and is the largest foreign direct investment in Egyptian history, the state-owned news outlet Al-Ahram reported.

Why it matters: The massive investment is welcome news for Egypt. The country has been struggling with a foreign currency shortage for years due to decreased tourism during the COVID-19 pandemic as well as rising commodity prices following the 2022 Russian invasion of Ukraine.

More recently, Egypt has been reeling from a significant decrease in Suez Canal trade volume due to the Houthi rebels in Yemen attacking ships in the Red Sea.

Madbouly said the Emirati investment will help with the currency crunch, according to Al-Ahram.

The $35 billion investment is larger than expected. An Egyptian official told CNBC Arabia earlier this month that the Emirates was in talks to invest $22 billion in the project.

Know more: ADQ’s investment in Ras El-Hekma builds on previous Emirati investments in Egypt in recent years. In January, the UAE ports operator AD Ports Group announced a $3 million investment in Red Sea cruise ship terminals.

Emirati firms also purchased stakes in Egyptian state companies last year as part of Egypt’s privatization push. In November, Cairo sold a stake in the tobacco firm Eastern Company to the UAE’s Global Investment Holding Co.